There are three types of CFOs in the world today and none of them are likely to go extinct in the near future. Their roles and compensation are quite different, however, so IF you’re a CFO, the question becomes:

As a CFO, who are you today and who do you want to be tomorrow?

The three CFO types are:

CLASSIC CFO: the steward of the company’s financial history, internally and historically focused.STRATEGIC CFO: works with multiple ERP systems recent data and KPIs, coordinating finance across departments.THE CEO'S PARTNER: with real-time end-to-end information from digitalized system, able to suggest pivots and changes NOW to react NOW to factors changing NOW...

Nick concurs that Classic CFOs are here to stay, even with increasing corporate digitalization, because their function is needed by smaller companies (less than $100M in annual revenues) and in privately owned companies where there’s not much change in the environment, key personnel, ownership, or processes.

What can a Classic CFO do to prepare the corporation for change if it should occur that would also be valuable to the corporation in its current state? Nick says that a Classic CFO can instill in the accounting department a culture of:

Objectivity and integrity of the data: “Validate key assumptions from different angles. Yes, the computer says ‘such and such,’ but where can we look to confirm in the broad external world that the output from the computer is reasonable?”Mutual trust and camaraderie: “which is established and maintained by:Involving everyone in decisions because such actions cultivate individual ownership of inputs and outputs.If, as CFO, you’re wrong, admit it because your own admission creates an environment where failures, however small, are shared and corrected without serious cost—the "fail and fail fast” principal is instilled and the likelihood of a hidden major fiasco diminishes.Ask for ‘what do you agree/don’t agree with, concerned about/have question(s) regarding, etc. statements’ because your repeated requests for input will surface what individuals really think and re-emphasize each employee’s value to the company/department, which has been shown to raise employee satisfaction and productivity while reducing turnover.”

Great advice, Nick.

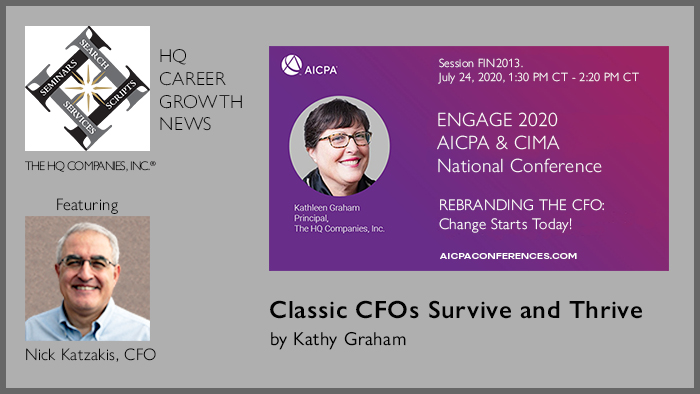

If you would like to hear more advice on the role and branding of each type of CFO, how to align your CFO brand with the economic environment your company is facing today/tomorrow, and how to change or tweak your CFO brand to influence key stakeholders and gain the highest ROI personally and for your corporation, I’ll be discussing these topics at AICPA & CIMA ENGAGE 2020 on Friday, July 24th from 1:30pm to 2:20pm Central Time in the session “REBRANDING THE CFO: CHANGE STARTS TODAY!” This virtual session is highly interactive and focused upon answering YOUR QUESTIONS.

- Use the code ENG20FIN to save $100—the conference starts today and any sessions you missed can be watched later via your access to the recordings of all sessions.